Shedding light on NADAC: How pricing power influences pharmacy reimbursement

By Michael Murphy, PharmD, MBA and Jennifer Rodis, PharmD, FAPhA for the PolicyRx newsletter

The past year has exposed a little-seen but enormously important sector of the pharmacy reimbursement system: how much pharmacies actually pay to acquire medications.

At the center of this conversation is the National Average Drug Acquisition Cost (NADAC), a federal pricing benchmark used by most state Medicaid programs—and increasingly by commercial plans—to reimburse pharmacies for ingredient costs (i.e., the cost of the drug product). Recent disruptions to NADAC have not only created challenges for many independent pharmacies but also exposed the stark disparities in drug acquisition costs between large chains and smaller, independent providers.

This issue of PolicyRx explores NADAC, why it matters and what recent volatility reveals about pricing power, transparency and the future of pharmacy reimbursement.

What is NADAC?

The National Average Drug Acquisition Cost is calculated by the Centers for Medicare & Medicaid Services (CMS) through a voluntary monthly survey of retail community pharmacies. Pharmacies submit the price they paid to acquire drugs from wholesalers, specifically the invoice list price, excluding off-invoice discounts, pre-bates, rebates or other price concessions.

The goal is to generate a fair national benchmark that Medicaid and other payers can use to reimburse pharmacies. However, the survey's voluntary nature, along with differences in purchasing power among pharmacies, makes the NADAC a sensitive and complex tool.

A volatile year: What happened in 2024?

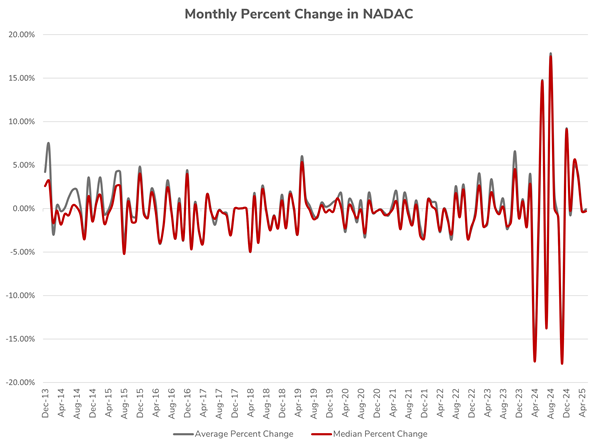

NADAC pricing typically fluctuates only modestly. But beginning in 2024, that changed dramatically. Pharmacies across the country started experiencing severe month-to-month reimbursement shifts. Here is a rough graph Michael pulled together of the monthly percent change in NADAC based on information available publicly on the CMS website:

These shifts were later traced back to a new development: For the first time, a large chain pharmacy participated in the NADAC survey and reported invoice prices across all locations selected. Their acquisition costs were significantly lower than those of other respondents, which lowered the average. However, because their data stayed within two standard deviations, it remained part of the final benchmark. (For those desiring a deeper dive, check out this analysis conducted by 46 Brooklyn.)

In August 2024, rates rebounded again, suggesting the chain had stopped participating. But in November 2024, NADAC rates plunged once more. CMS confirmed that this time, a different large chain pharmacy had submitted survey data, again lowering rates significantly. While CMS has taken short-term steps to smooth the volatility, pharmacists and policymakers must consider the broader implications of this disruption.

What the volatility reveals: Pricing power and inequality

The NADAC disruptions of 2024 provided a rare window into the structural imbalances in the drug supply chain. For the first time, we saw publicly how drug acquisition costs vary dramatically among pharmacies. This differs from the focus of recent years on how much pharmacies are reimbursed by pharmacy benefit managers (PBMs) for drugs dispensed.

Several key insights emerged:

- Differences in buying power: When a single large chain submitted data, its lower invoice prices significantly reduced the national average. This highlighted some chains' immense leverage in negotiating prices with wholesalers, an advantage not shared by independent or smaller pharmacies.

- Lack of pricing standardization: Even though NADAC excludes rebates and discounts, the submitted invoice prices vary widely. These disparities exist before any further reimbursement adjustments by PBMs amplify the problem.

- Methodology limitations: NADAC is designed to exclude outlier data beyond two standard deviations; we have now observed that submitting data for all locations allows large chains to move the average enough that their low prices fall within this range. As a result, their data can shift the benchmark in ways that smaller pharmacies cannot counterbalance.

This volatility exposed the complexity and inequality in drug acquisition costs and underscored the importance of reforming how benchmarks like NADAC are used in reimbursement systems.

Why this matters for drug payment reform

At the core of drug payment reform is a straightforward principle: Pharmacies should be reimbursed in a way that reflects their costs. Ideally, this would include:

- Payment for the actual cost of acquiring a drug

- A fair and reasonable dispensing fee that covers labor, overhead, and sustainable operating margins

Such a model would allow pharmacies to operate transparently and predictably, while helping stem the tide of pharmacy closures nationwide.

But what we are learning from NADAC volatility is that the inputs into that reimbursement equation (what a pharmacy pays for the drug) and the outputs (what they are reimbursed) are vastly different from pharmacy to pharmacy. We knew the outputs were different, thanks to recent audits showing vast reimbursement differences from one pharmacy to the next.

Still, it’s not clear how widely the significance of this divergence in acquisition cost between pharmacies was known. These differences are driven by the pharmacy’s size, supplier contracts, and its relationships within the supply chain, which are not publicly available.

Because the NADAC survey is voluntary and has primarily been completed by small and independent pharmacies, NADAC-based reimbursement has yielded higher profit margins for pharmacies with stronger buying power. These pharmacies can purchase drugs at discounted rates and benefit from reimbursement rates based on the higher prices reported by others. This may create a disincentive for large chains to participate.

While it is possible to argue that certain pharmacies may benefit from these different margins, it is important to recognize that the pharmacy business sector has been unhealthy financially for many years. In many cases, pharmacies may be using higher reimbursement for some medications to offset lower payments on others, attempting to stay solvent amid the compound impacts of inadequate dispensing fees.

Policy options: Navigating tradeoffs in acquisition cost reform

Policymakers are beginning to explore ways to improve acquisition cost benchmarks while addressing NADAC's limitations. Below are four leading policy options under discussion.

1 Mandate Pharmacy Participation in NADAC surveys

Overview

This policy would require pharmacies to participate in the monthly NADAC survey to ensure comprehensive and consistent data collection. By capturing acquisition costs from all pharmacy types, the NADAC benchmark would better reflect the whole market and limit the impact of selective participation or data volatility. At the time of writing, in June 2025, Congress is actively considering this policy as part of a reconciliation bill that also includes other important reforms to the PBM industry aimed at improving pharmacy sustainability.

Pros

- Creates a more accurate benchmark by including all pharmacy types

- Prevents selective participation and reduces data skewing and volatility

- Improves pricing transparency for payers and policymakers

Cons

- Fails to reflect the significant variation in acquisition costs between pharmacies

- Likely to lower NADAC rates overall, which could further threaten pharmacy sustainability

- May require additional adjustments to dispensing fees to prevent underpayment

2 Implement state-based mandated acquisition cost surveys

Overview

Instead of relying on a national voluntary survey, states would implement their own mandatory acquisition cost surveys. Each state would require in-state pharmacies to report invoice prices, allowing Medicaid programs to develop localized reimbursement benchmarks that better reflect regional drug pricing and market dynamics.

Pros

- Reflects local drug pricing dynamics and state-specific markets

- Ensures consistent participation and limits survey-driven volatility

- Provides states with more control over their Medicaid pharmacy reimbursement strategies

Cons

- Does not fully account for variations in pharmacy costs within the same state

- Adds complexity for pharmacies that operate in multiple states

- Requires significant state infrastructure and administration

3 Establish tiered pricing benchmark surveys based on pharmacy purchasing power

Overview

This approach would require CMS (or state agencies) to set different acquisition cost benchmarks based on tiers that reflect a pharmacy’s size and purchasing leverage. Rather than a single NADAC rate, there would be separate NADACs for independently owned pharmacies, regional chains, and large national chains. Each would be reimbursed based on the average acquisition costs reported by similarly situated pharmacies.

Pros

- More accurately reflects the actual acquisition costs paid by different types of pharmacies

- Prevents large chains with lower costs from skewing benchmarks that apply to smaller pharmacies

- Creates a fairer reimbursement structure by recognizing that not all pharmacies operate under the same market conditions

Cons

- Implementation would be complex, requiring CMS or states to classify pharmacies and manage multiple pricing files

- Without comprehensive reform across all payers, and without pairing this with adjusted dispensing fees, it could financially strain large chain pharmacies that currently benefit from uniform, higher NADAC-based reimbursement

- May introduce legal or political challenges if viewed as creating preferential treatment or discrimination among providers

- Could lead to additional closures if large chains are not prepared to absorb reimbursement cuts

4 Enforce pricing uniformity among wholesalers under the Robinson-Patman Act

Overview

This policy would seek to reduce the variation in drug acquisition costs by requiring drug wholesalers to offer equal pricing to all pharmacy customers for the same products and quantities.

The federal Robinson-Patman Act prohibits price discrimination in many industries, though it has rarely been enforced in the pharmaceutical sector. A renewed focus on enforcement could help address acquisition cost disparities at the source.

Pros

- Addresses pricing inequality at the root, reducing the gap between what different pharmacies pay for the same medications

- Empowers the pharmacy community to pursue drug pricing reform on both ends: reducing acquisition cost variation and improving reimbursement models

- Could create a more transparent and competitive marketplace for pharmacy purchasing

Cons

- U.S. economic policy has generally avoided enforcing uniform pricing in private supply chains, except in rare, highly regulated sectors

- May face strong resistance from wholesalers, manufacturers, and large purchasers who benefit from tiered pricing models

- May introduce legal or political challenges if viewed as creating preferential treatment or discrimination among providers

- Could inadvertently increase prices for smaller pharmacies if wholesalers adjust pricing strategies to maintain margins

A call to action: Transparency, sustainability and fairness

NADAC has shown that transparency alone is not enough. Reform must be paired with structural changes that reflect the complex reality of pharmacy operations. Ingredient cost reimbursement, dispensing fees, and PBM reform are all connected. Addressing just one element will not create a sustainable solution.

Now is the time for pharmacists, student pharmacists, and advocates to press for a reimbursement system that reflects the real-world costs of care. This means ensuring a level playing field, sustaining community pharmacy services, and protecting patient access in every setting.

Stay tuned for future issues of PolicyRx as we continue breaking down complex pharmacy policy issues.

Pharmacists are at the forefront of a rapidly changing health care landscape. It is essential that current and future pharmacists understand complex policy issues to ensure patients continue to receive timely access to essential medications and the expert care they deserve.

PolicyRx, an email series from The Ohio State University College of Pharmacy, aims to break down these issues into actionable insights, empowering pharmacists to engage with the evolving health care environment.